The Covid-19 pandemic saw the emergence/growth of a new business segment, the Ed-tech industry. India witnessed the advent of 4 Ed-tech unicorns, having raised over USD 4 billion since 2020, indicating an increasing interest of investors in the segment that usually went unnoticed. Prior to 2019, the industry was one of the least funded segments, with around 25% of the start-ups launched between 2014 to 2019 shutting shops. Now there are over 4000 Ed-tech start-ups in India, 435 of which were established in 2019.

India is seen as a key strategic market and the 2nd largest market for Ed-tech start-ups after the US (according to a Crunchbase report) for obvious reasons – a largely untapped market, a thriving start-up space and policy attention.

- Policies like the National Education Plan (NEP) are attempting to encourage vernacular languages as the medium of education, furthering the scope of accessibility to remote areas and villages.

- Increased use of the internet and smartphones in remote areas can result in long-term stability and sustainability of the Ed-tech industry.

- Cost efficiency of online education platforms compared to traditional schools and institutions (without compromising the quality of education) also plays a vital role in the growth of the Ed-tech industry.

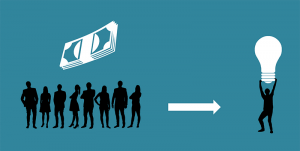

While the industry prospects are on the rise, stakeholders should hedge their risks before investing in India. Following are some of the risks that companies need to understand and navigate:

- A data breach is a common risk in the Ed-tech sector, more so due to the involvement of minors on these platforms. Stringent technological monitoring is a must to ensure data protection.

- There is a sizeable gap between the accessibility of technology and internet services in rural and urban areas, which has raised concerns over the unaccountability of students nationally ever since the onset of the pandemic.

- The return of offline education post-pandemic could affect the online educational platforms; however, the dependency of students on Ed-tech for a more one-on-one approach reduces the risk.

- The lack of an EdTech Policy in India results in the absence of an integrated roadmap to navigate the efforts of governments and private stakeholders.

- The domestic ed-tech market faces a threat of over-saturation with the rise of multiple start-ups, many lacking an innovative and robust business model.

- The lack of familiarity with the international Ed-tech markets (which is vastly different from India) poses a threat to the stakeholders in India, who maybe looking to expand their ventures abroad.